Subtitles & vocabulary

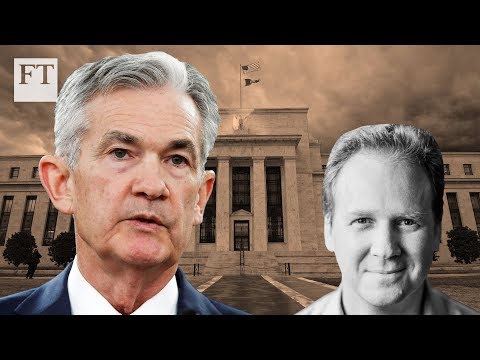

Why are Federal Reserve members split on raising rates? I FT

00

林宜悉 posted on 2020/03/23Save

Video vocabulary

figure

US /ˈfɪɡjɚ/

・

UK /ˈfiɡə/

- Verb (Transitive/Intransitive)

- To appear in a game, play or event

- To calculate how much something will cost

- Noun

- Your body shape

- Numbers in a calculation

A1TOEIC

More basically

US /ˈbesɪkəli,-kli/

・

UK /ˈbeɪsɪkli/

- Adverb

- Used before you explain something simply, clearly

- In essence; when you consider the most important aspects of something.

A2

More determine

US /dɪˈtɚmɪn/

・

UK /dɪ'tɜ:mɪn/

- Transitive Verb

- To control exactly how something will be or act

- To establish the facts about; discover

A2TOEIC

More bias

US /ˈbaɪəs/

・

UK /'baɪəs/

- Noun (Countable/Uncountable)

- Preference to believe things even if incorrect

- A systematic error in a statistical result

- Transitive Verb

- To unfairly favor one view over another

- To cause someone to have prejudice

B1TOEIC

More Use Energy

Unlock Vocabulary

Unlock pronunciation, explanations, and filters