Subtitles & vocabulary

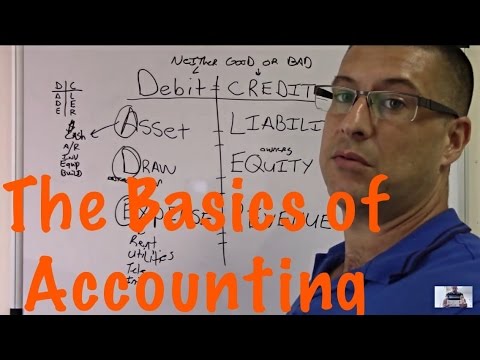

Accounting For Beginners #2 / Basics / Accounting Equation / Accounting Tutorial

00

挑食多 posted on 2017/01/13Save

Video vocabulary

struggle

US /ˈstrʌɡəl/

・

UK /'strʌɡl/

- Verb (Transitive/Intransitive)

- To try very hard to do something difficult

- To fight or struggle violently

- Noun (Countable/Uncountable)

- Strong efforts made to do something difficult

- A difficult or challenging situation or task

A2

More bunch

US /bʌntʃ/

・

UK /bʌntʃ/

- Noun (Countable/Uncountable)

- A group of things of the same kind

- A group of people.

- Transitive Verb

- To group people or things closely together

B1

More positive

US /ˈpɑzɪtɪv/

・

UK /ˈpɒzətɪv/

- Adjective

- Showing agreement or support for something

- Being sure about something; knowing the truth

- Noun

- A photograph in which light areas are light and dark areas are dark

A2

More mess

US /mɛs/

・

UK /mes/

- Noun (Countable/Uncountable)

- Something that is untidy, dirty or unclean

- A difficult or confused situation.

- Transitive Verb

- To make something untidy or dirty

A2

More Use Energy

Unlock Vocabulary

Unlock pronunciation, explanations, and filters