Subtitles & vocabulary

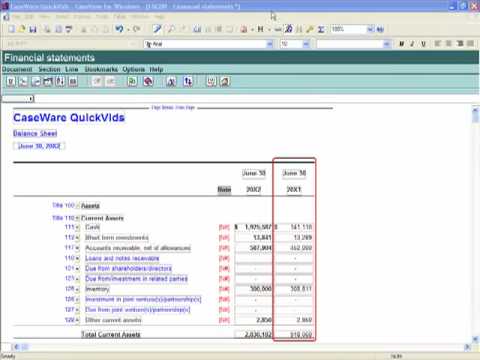

GAAP Financials: Working in the Financial Statements - Quarterly Reporting

00

陳虹如 posted on 2017/06/23Save

Video vocabulary

equivalent

US /ɪˈkwɪvələnt/

・

UK /ɪˈkwɪvələnt/

- Adjective

- Equal to something in value, use or meaning

- Having the same meaning or significance.

- Noun

- Thing like another in quality, quantity or degree

B1TOEIC

More demonstrate

US /ˈdɛmənˌstret/

・

UK /'demənstreɪt/

- Verb (Transitive/Intransitive)

- To display a feeling or ability openly

- To protest about something often as a group

A2TOEIC

More period

US /ˈpɪriəd/

・

UK /ˈpɪəriəd/

- Noun (Countable/Uncountable)

- Set amount of time during which events take place

- A way to emphasize what you will say

A1TOEIC

More recommend

US /ˌrɛkəˈmɛnd/

・

UK /ˌrekə'mend/

- Transitive Verb

- To advise or suggest that someone do something

- To endorse or support something publicly.

A2TOEIC

More Use Energy

Unlock Vocabulary

Unlock pronunciation, explanations, and filters