Subtitles & vocabulary

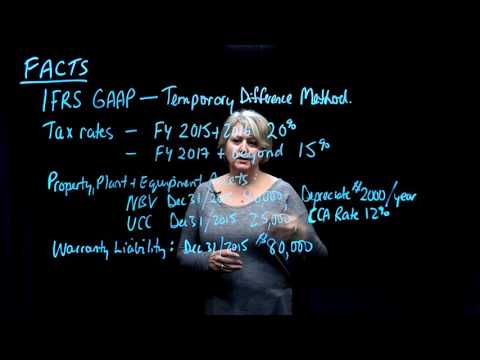

Income Tax Accounting (IFRS) | Example Facts - Part 1 of 4

00

陳虹如 posted on 2017/06/23Save

Video vocabulary

relevant

US /ˈrɛləvənt/

・

UK /ˈreləvənt/

- Adjective

- Having an effect on an issue; related or current

A2TOEIC

More assume

US /əˈsum/

・

UK /ə'sju:m/

- Transitive Verb

- To act in a false manner to mislead others

- To believe, based on the evidence; suppose

A2TOEIC

More situation

US /ˌsɪtʃuˈeʃən/

・

UK /ˌsɪtʃuˈeɪʃn/

- Noun (Countable/Uncountable)

- Place, position or area that something is in

- An unexpected problem or difficulty

A1TOEIC

More gross

US /ɡros/

・

UK /ɡrəʊs/

- Noun (Countable/Uncountable)

- 144 of something; twelve dozen of something

- Total sum of money earned before costs and taxes

- Transitive Verb

- To earn an amount of money before costs and taxes

B1TOEIC

More Use Energy

Unlock Vocabulary

Unlock pronunciation, explanations, and filters